The $3M Exit That Rejected Traditional Wealth Management: How One Founder Built a Wyoming Holdco Instead

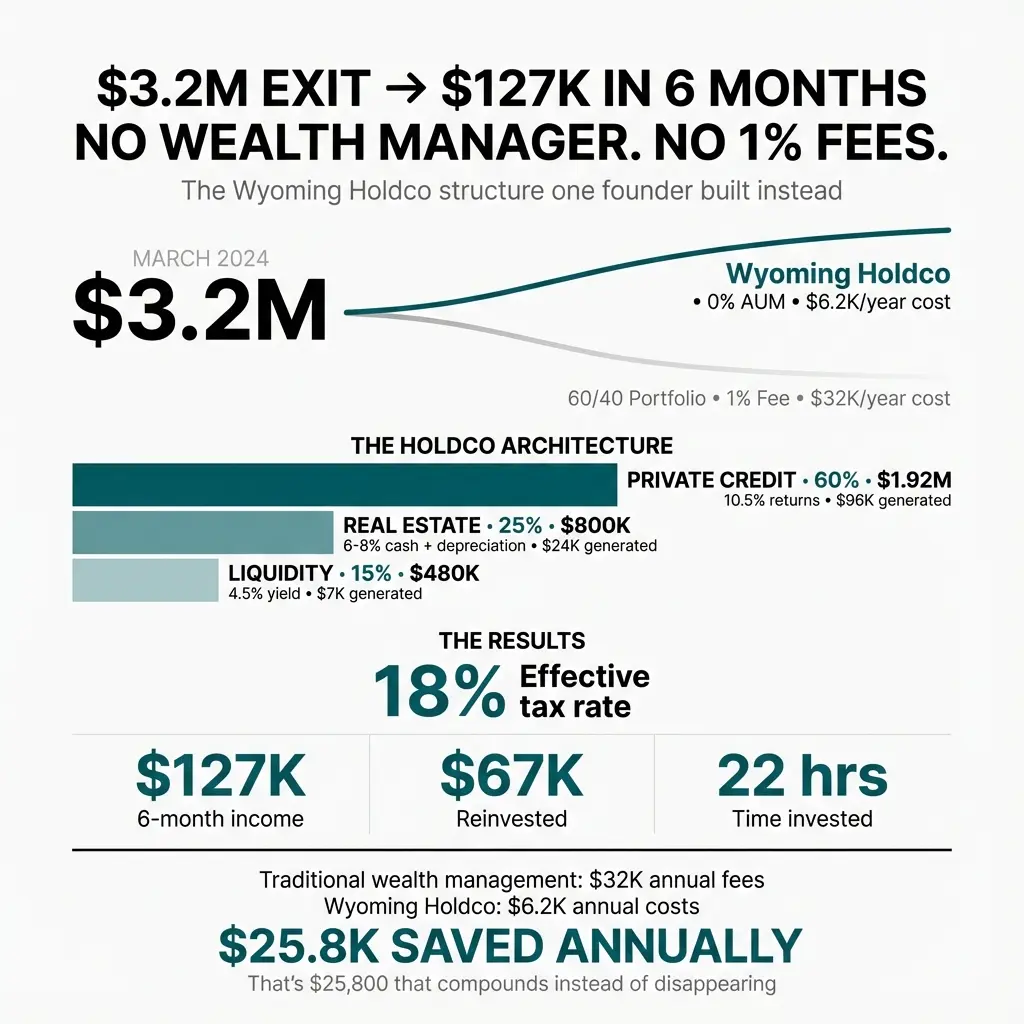

Jason closed his SaaS exit in March 2024 with $3.2M after taxes.

Within 72 hours, three wealth managers pitched him the same portfolio: 60% equities, 40% bonds, and a 1% annual fee. They promised diversification, professional management, and peace of mind.

He declined all three.

Six months later, Jason's capital sits in a Wyoming holding company generating passive income through private credit and real estate syndications. No AUM fees. No quarterly rebalancing calls. Full control.

This is the structure he built, why it works, and what other founders can learn from his approach.

The Problem With Post-Exit Wealth Management

Traditional wealth management assumes you want to hand over control in exchange for convenience.

The pitch sounds reasonable: let professionals manage your money while you focus on your next venture. But the model creates three friction points for founders:

First, the fee structure eats compounding potential. A 1% annual fee on $3M costs $30,000 in year one—capital that can't compound when it's going to fees.

Second, the 60/40 portfolio prioritizes diversification over income. For a founder who just spent seven years building cash flow, switching to a portfolio that generates 2-3% dividend yield feels like regression. Jason wanted passive income, not beta exposure to the S&P 500.

Third, you lose decision-making rhythm. Wealth managers make allocation decisions quarterly or annually. Founders are used to weekly or monthly capital deployment cycles. The pace mismatch creates frustration.

Jason recognized these issues immediately. He didn't want to optimize for diversification. He wanted to optimize for control, privacy, and passive income.

Why Wyoming? The Holdco Advantage

Jason formed a Wyoming LLC as his holding company in April 2024.

The decision wasn't about secrecy or tax evasion. It was about structure, privacy, and asset protection in a jurisdiction designed for exactly this use case.

Wyoming offers three specific advantages that matter for post-exit founders:

Asset protection through charging order protection. If a creditor wins a judgment against Jason personally, they can't seize LLC assets. They're limited to distributions only. This exclusive remedy makes collection extremely difficult because creditors can't force Jason to give up ownership interests. Single-member LLCs benefit from this protection in Wyoming, which is rare among states.

Privacy by design. Wyoming doesn't require member or manager disclosure in public records. Jason's name doesn't appear on any public filing. This confidentiality matters for founders who want to keep their involvement private for competitive or security reasons.

Minimal fees and administrative burden. Wyoming's annual maintenance fee is $60. Compare that to Delaware's $300 annual tax or California's $800 minimum franchise tax.

The Wyoming Holdco became Jason's mini family office balance sheet. All capital sits here. All investments flow through here. All tax planning happens here.

The Entity Architecture

Jason's structure uses three layers:

Layer 1: Wyoming Holding LLC (single-member, Jason as owner)

This is the parent entity. It holds all capital and owns interests in operating entities or investment vehicles. Jason is the sole member and manager. The LLC is taxed as a pass-through entity, meaning profits flow to Jason's personal return.

Layer 2: Operating entities or investment vehicles

The Holdco invests in private credit funds, real estate syndications, and other income-generating assets. These investments are held as membership interests in other LLCs or limited partnerships. The Holdco receives distributions from these entities.

Layer 3: Banking and custody infrastructure

Jason opened a business checking account at a regional bank in Wyoming. He also established a brokerage account under the LLC name for liquid reserves. All income flows into the Holdco accounts. All expenses and investments flow out.

This structure creates a clear separation between personal finances and investment capital. Jason pays himself a modest salary from the Holdco for living expenses. Everything else stays inside the entity to compound.

The Capital Deployment Strategy

Jason allocated his $3.2M across three buckets:

Bucket 1: Private Credit (60% / $1.92M)

Private credit delivered 10.5% annualized returns in Q4 2024, beating high-yield bonds and leveraged loans even during Federal Reserve rate cuts. During rising-rate periods since 2008, direct lending averaged 11.6% returns—two percentage points above its long-term average.

Jason invested in two direct lending funds focused on middle-market companies. These funds provide senior secured loans to businesses with $10M-$100M in revenue. The loans typically carry floating rates tied to SOFR plus 500-700 basis points.

The structure offers three advantages:

Predictable income. Quarterly distributions average 9-11% annually. Jason receives roughly $43,000-$53,000 per quarter from this allocation.

Low volatility. Private credit closed-end funds posted 6.9% annual returns in 2024, outperforming private equity's 5.6% for the third consecutive year. Mid-market private credit continues to deliver low double-digit returns on senior secured debt with conservative structures and robust lender protections.

Structural flexibility. The pass-through structure allows Jason to work with his accountant on timing and planning, rather than being locked into a rigid fund structure.

Bucket 2: Real Estate Syndications (25% / $800K)

Jason allocated $800K across four real estate syndications: two multifamily projects in Texas and two industrial properties in the Southeast.

These investments provide two income streams:

Cash-on-cash returns of 6-8% annually through rental income distributions. Jason receives roughly $12,000-$16,000 per quarter from this bucket.

Potential depreciation benefits that real estate syndications typically offer. Jason's accountant helps him understand how these work within his overall financial picture.

Bucket 3: Liquidity Reserve (15% / $480K)

Jason keeps $480K in a high-yield savings account earning 4.5% and a short-term Treasury ladder. This bucket serves three purposes:

Emergency capital for unexpected expenses or opportunities.

Dry powder for new investments that meet his criteria.

Cash flow buffer to smooth out timing mismatches between distributions and expenses.

This allocation generates roughly $21,600 annually with zero volatility.

Why the Structure Works

The Holdco structure creates operational advantages that compound over time.

Clear separation between personal and investment capital. Jason pays himself a modest salary for living expenses. Everything else stays inside the structure to reinvest. This creates a psychological and operational boundary that prevents lifestyle creep.

Professional expense allocation. The Holdco covers legitimate business expenses: accounting fees, legal fees, travel to evaluate investments, and professional development. These stay separate from personal finances.

Coordination with tax planning. Jason's CPA uses the structure to optimize timing and strategy. The specifics vary based on his situation, but the structure gives his accountant tools to work with.

The Decision-Making Rhythm

Jason reviews his Holdco quarterly.

Each review follows the same agenda:

Income analysis: How much did each bucket generate? Are distributions on track?

Expense review: What did the Holdco spend? Are expenses justified?

Redeployment decisions: Is there excess cash to reinvest? Do any positions need adjusting?

Planning check-in: What's coming up that needs coordination with his CPA or attorney?

This rhythm keeps Jason engaged without requiring daily attention. He spends roughly 4-6 hours per quarter managing the structure. Compare that to the weekly market-watching that comes with a traditional brokerage account.

What This Requires

Jason's structure isn't passive. It requires coordination across three professional relationships:

A Wyoming-licensed attorney who understands LLC formation and asset protection. Jason paid $2,500 for formation and operating agreement drafting.

A CPA familiar with pass-through entities and alternative investments. Jason pays $4,500 annually for tax preparation and quarterly planning calls.

An insurance advisor who can structure umbrella coverage and liability protection around the Holdco. Jason carries $5M in umbrella coverage for $1,200 annually.

Total annual cost: roughly $6,200 plus the $60 Wyoming filing fee.

Compare that to 1% AUM on $3.2M: $32,000 annually.

The savings pay for the professional team with $25,000+ left over to compound.

The Results Six Months In

Jason's Holdco generated $127,000 in distributions from April through September 2024.

Private credit delivered $96,000. Real estate syndications contributed $24,000. The liquidity reserve added $7,000.

After paying himself a $60,000 salary for living expenses, Jason reinvested $67,000 into new positions: one additional private credit fund and one opportunistic real estate deal.

His accountant handles the tax coordination and filing.

His time commitment: 22 hours across six months, or roughly 3.7 hours per month.

What Other Founders Can Learn

Jason's approach won't work for everyone. But it reveals three principles that apply broadly:

First, control matters more than diversification for some founders. If you spent years building a business, handing capital to a wealth manager can feel like regression. Structure alternatives exist.

Second, working with the right professionals creates leverage. Jason's CPA and attorney help him optimize the structure in ways that compound over time. The right team matters.

Third, the right structure creates decision-making clarity. Jason knows exactly where his capital sits, what it generates, and how to redeploy it. That clarity reduces anxiety and improves outcomes.

The Wyoming Holdco isn't magic. It's simply a tool that aligns structure with goals.

For founders who want passive income, tax efficiency, and control, it's worth exploring.

The Path Forward

Jason plans to hold this structure for at least 10 years.

His goal: build the Holdco balance sheet to $10M by age 50 through reinvested distributions and new capital from future exits or ventures.

He's not chasing unicorn returns. He's building a permanent capital vehicle that generates income, protects assets, and compounds tax-efficiently.

That's a different game than traditional wealth management plays.

And for founders who understand the difference, it's a game worth playing.